These full month data are from prior months, so this data below is for the month of March 2020.

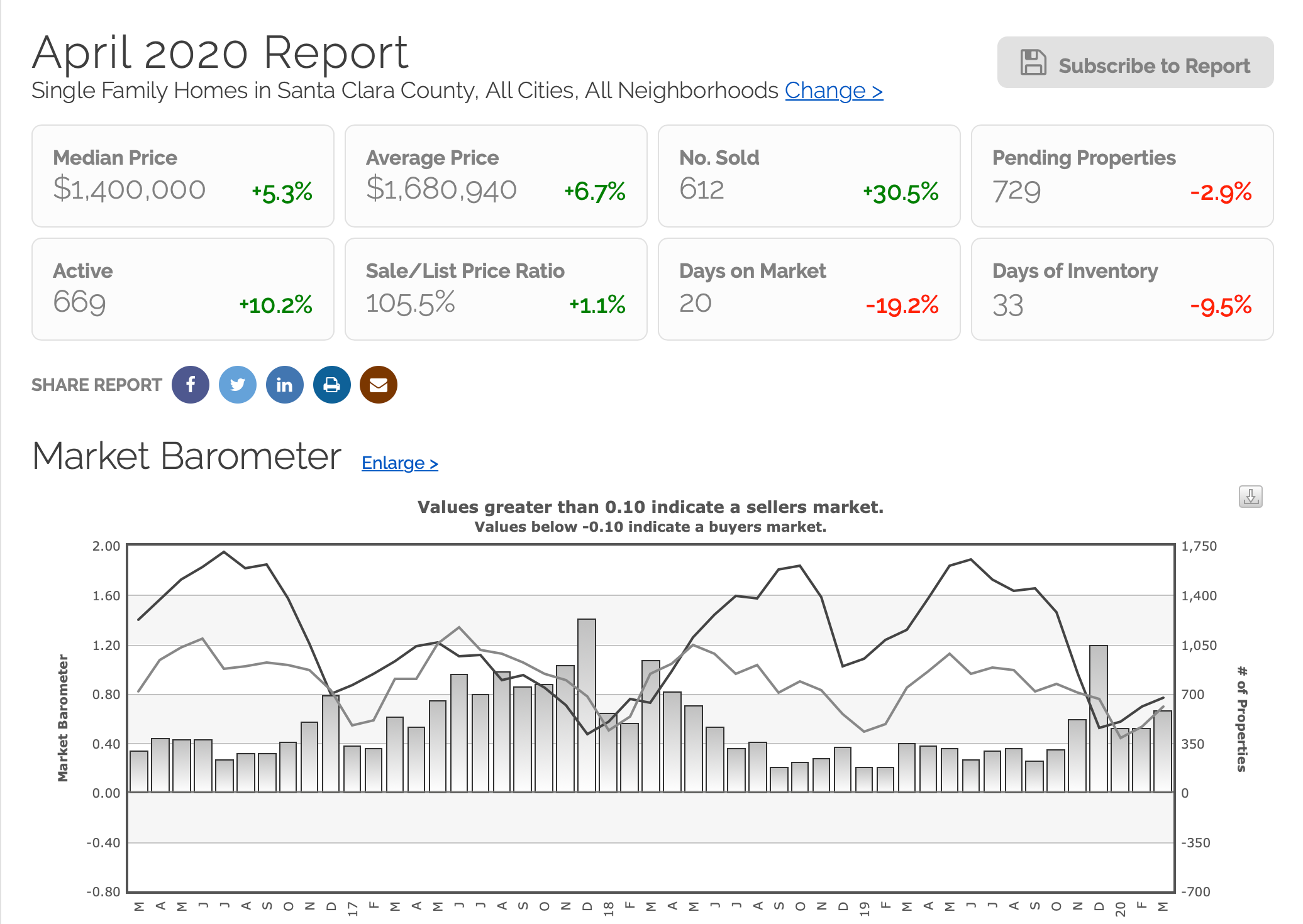

Single Family Residences

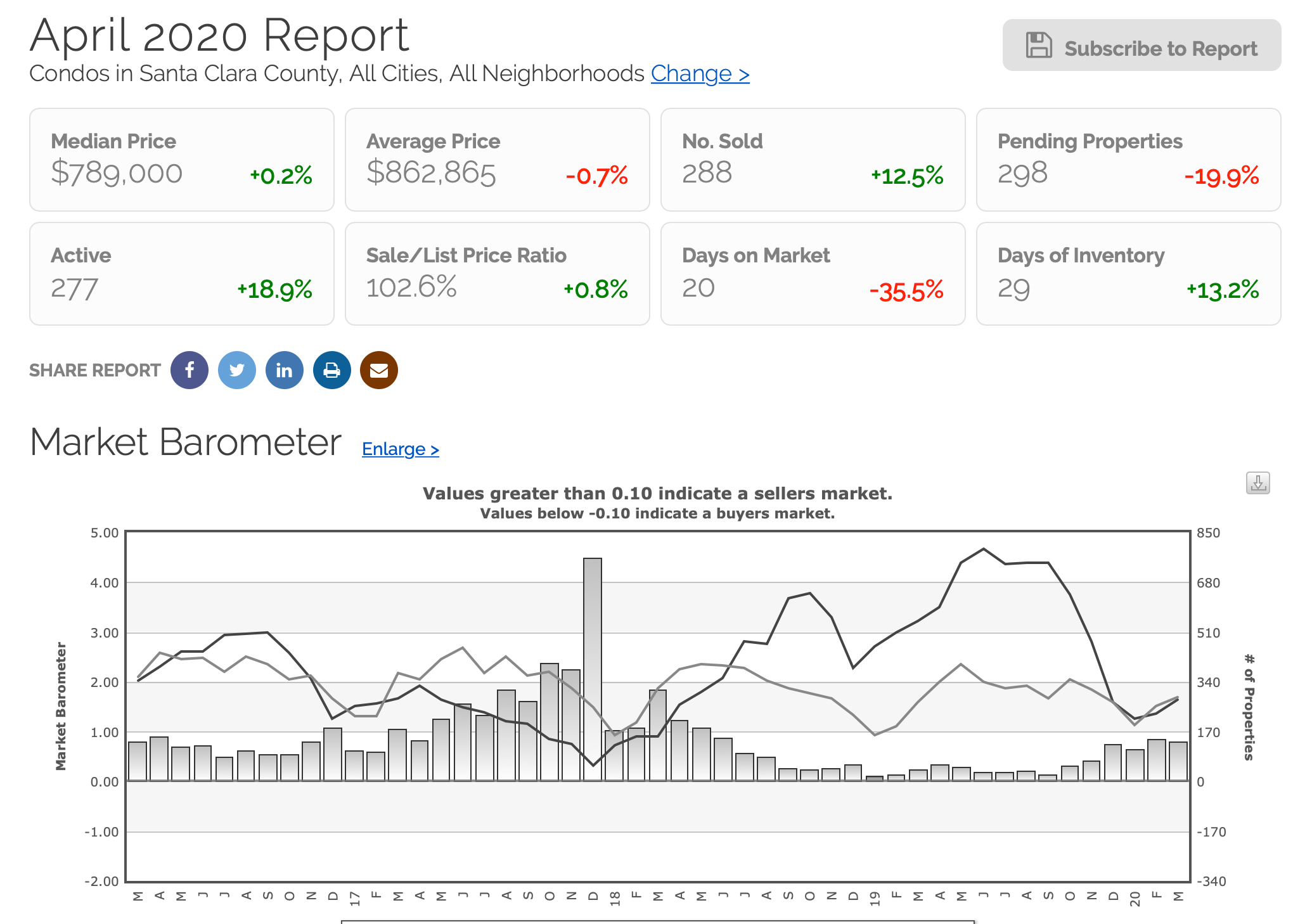

Condo/Townhomes

With California now entering the fourth week of SIP (Shelter in Place 3/17/20) Order the impact on the real estate industry is dramatic but we are quite sure of the full impact yet. Typcially escrow periods are roughly 30 days, so the true, measureable impact will not be readily available until the end of April after seeing a full month with SIP in place.

The month of March, as you can see below was quite good and headed in a favorable direction heading into the spring season with prices going up and days on market decreasing. Things were looking very rosy in the real estate space.

The word out in the streets from most real estate professionals is that the market has come to a dramatic slowdown as open houses and organized tours are still prohibited and buyers can only visit homes that are vacant or do virtual tours. Too much uncertaincy as to what to expect from this pandemic.

The fear of the slowing economy and the initial drop in the stockmarket brought fear in the hearts of buyers in Silicon Valley for whom many will need to liquidate stocks to access their down payment funds. The recent climb of the stock market has brought back some confidence but most are still in holding status.

Even with my clients we are seeing different paths to deal with this uncertaincy. One group feels the real estate market will be accelerated into the anticipated downturn that so many had been waiting for. These folks have decided to moved forward and put their properties on market; the longer they wait, the worse for their end results, so getting out ahead of the curve is better. The buyers are actively searching but not really biting the bulllet yet.

The other group just does not have sufficient evidence or data and would simply like to wait to see what things will look like; at least until the SIP has been lifted. They see opportunity in distressed markets. They may not get top dollars for their homes, but they also see buying opportunities which may more than offset whatever loss they may suffer. These folks want to take the wait and see approach. Many buyers will not be able to obtain loans after huge job losses, so those with the ability will have more options and opporunties.

Which side is correct? I don't know. I have never experienced a total shut down of society before. Anyone who says they know what to expect is lying or is an idiot. No one knows what is going to happen; they don't even know what percentage of our society is infected, let alone try to predict the future of the real estate market only after four weeks of a home lock down.

So all we can do is wait and see the data as we cautiously forge ahead.

See you next month to see what the market will look like.

#siliconvalleyrealestate #realestatenews #realestatesales #siliconvalleyrealestatemarket #siliconvalleymarkettrend #santaclaracountymarkettrend #siliconvalleymarketreport #santaclaracountymarketconditions #kwsv #kellerwilliams #stevemungroup #whoyouhireabsolutelymatters #work #realtor #realestate #siliconvalleyrealestate