It is the end of 2016 and the Presidential and Congressional Elections are over. Lots of things have happened in the past year, so Inevitably people question what will be happening in the coming year in Silicon Valley Real Estate Market.

Here are a few thoughts from what I have seen in the marketplace.

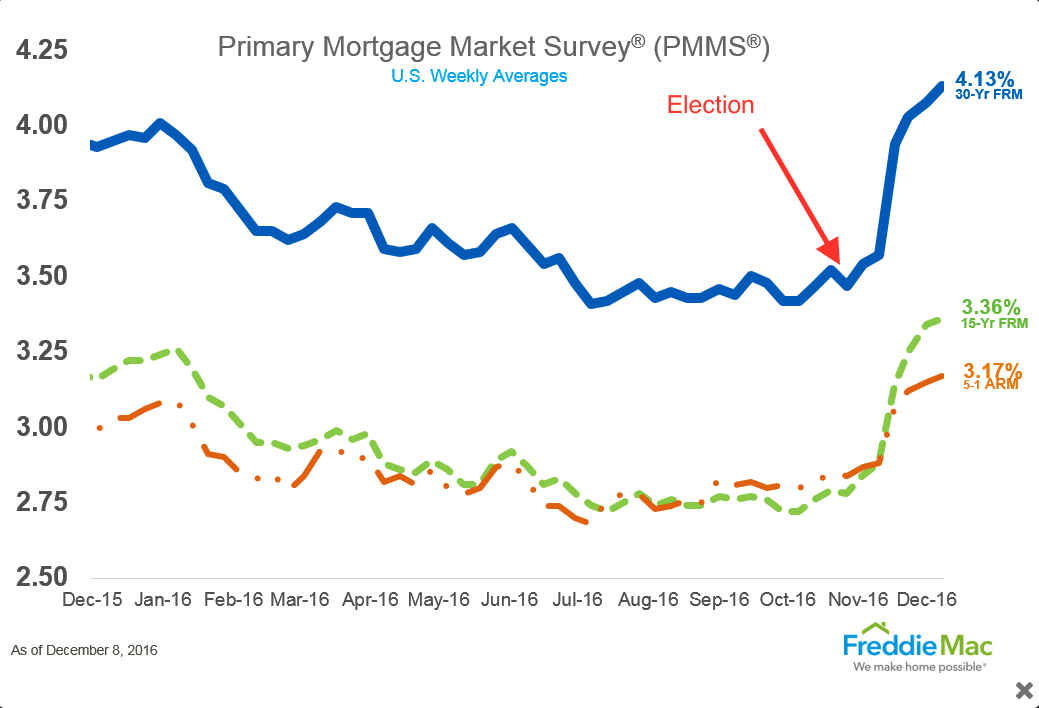

First, the elections are over and the mortgage rates have spiked to the highest rate this year and the speed at which it spiked Is unprecedented. The dramatic climb took place in a single month. This is huge. And this is before the Fed has even raised rates.

Without getting into the why this is happening, the fact is, the overall cost to purchase a home is higher for the average buyer. Their income probably has not increased, but the cost to borrow certainly has. Now, in a mater of a single month, some buyers have been priced out of certain price points and neighborhoods as the rising rates have increase their monthly payments or has decreased their loan approval amount. Buyers with less purchasing power will impact sellers and home prices overall.

The interest rate on the chart above went from about 3.5% to 4.15% in a single month. That probably does not look like a significant amount looking at this graph in isolation. But it may be different if we actually break it down to smaller bites and put it into perspective.

An $800,000 loan for a Rivermark buyer (median price of a home in Santa Clara County is $1 M), at 3.5% over 30 years would yield a monthly payment of $3,592 and the total interest paid over 30 years would be $493,248.

That same loan at 4.15% over 30 years would yield a monthly payment of $3,888 and the interest would be $599,977.

Yes, in the past month, that rise of .65% in rate will cost a buyer an extra $296 per month and add $106,729 to the overall cost of purchasing that same $1M house. This is not even a 1% increase, imagine what it will be if it goes up to 5%.

Will these types of increases in payment alter purchasing behavior? Some food for thought......

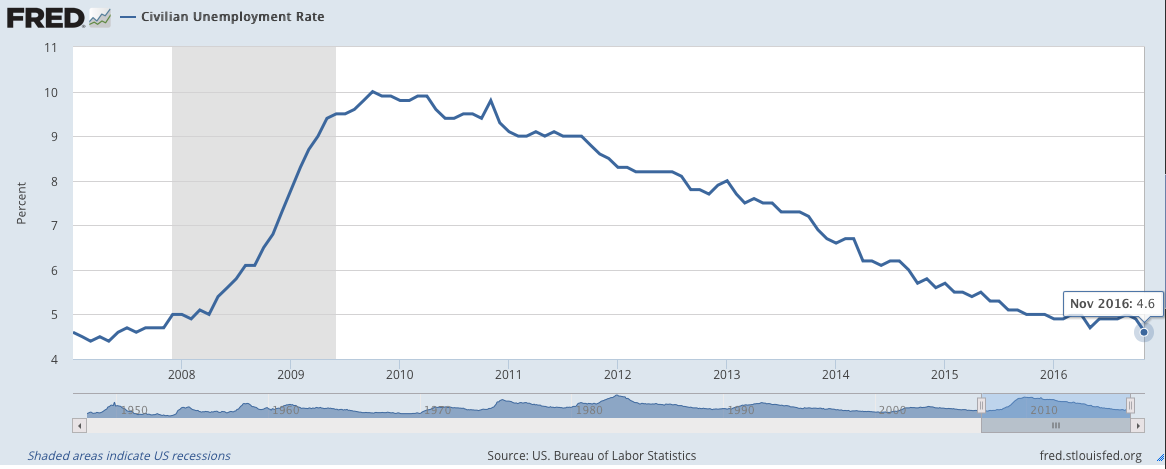

Second, the overall economy has been fantastic, especially here in Silicon Valley for several years, especially in tech sector, which is fueling a lot of the home purchasing behavior. If we look at the Unemployment Rate, the country has been doing fantastically well and is at a rate we have not seen since before the Great Recession. In November, we saw it drop to 4.6%.

Job numbers are looking great, so the Fed has already indicated that rising interest rates is in the horizon. Whether you agree with the policy or not, the announcement has been made.

The interest rate was kept artificially low for nearly a decade by the Fed to stimulate growth. There is no where to go, but up. The days of rising rates are ahead of us, that is simply a fact.

Third, in the US, the real estate market shifts about every 10 years. The high point in the Real Estate market before it took a turn was 2007. This means we are about due for another shift in the market. This has been the talk in the Real Estate community for the entire year, when will the shift happen. That is the $1M question. We are already seeing a noticeable slow down in the Luxury Markets in Silicon Valley as well as some of the less in demand areas in Santa Clara County.

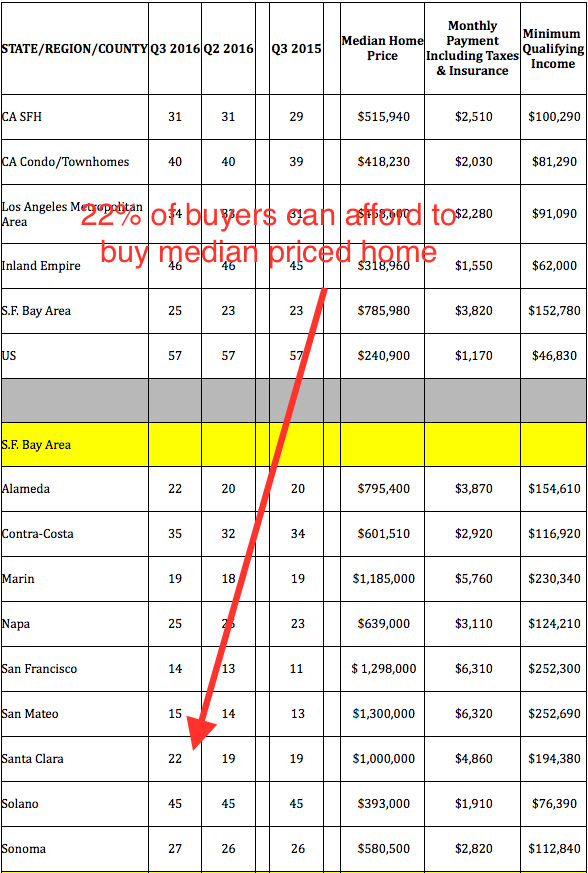

In line with that question, the housing affordability rate in California has been reaching historic lows as the prices have climbed. For Q3 2016, in Santa Clara County, only 22% of buyers could afford to buy a median priced home. In San Mateo County, that number is even lower at 15%. It had gone up slightly in the past two Quarters, but with the cost to borrow increasing so dramatically, affordability will surely drop further.

As we can see, quite a few things happening in the Real Estate space. Rates are spiking, unemployment rate has consistently been dropping and as the competitive nature of housing market has raised prices, buyers and their ability to afford a house has dropped to very low levels as expected. And we are about due for a shift in the market place.

So depending on whether you are contemplating on selling or buying a home in the next year Rivermark or other areas of Silicon Valley, you need to sit down and do some serious thinking about what you want to do and how to plan for the next step. It is time to talk to your lenders and discuss rates and ability to qualify if you are buying.

If you are a seller, you need to think about whether buyers can afford to buy your home and whether the days of multiple offers behind us now. The ultimate question is whether you want to prepare and be ahead of the curve or behind and reacting to it. No one knows for sure. There is no crystal ball. All you can do is look at the events around you and make the best informed decision.

Real Estate market is all about timing like most things in life. We are already seeing it in the market, buyers trying to lock in low rates and prices before they climb any higher; and in the luxury market and less in-demand areas, the market is starting to slow as days on market is rising and price reductions are posting. So the question becomes: Where do you and your family want and need to be?

As always, if you want some more information or feedback as to what we are seeing in out here in the Silicon Valley Real Estate market, please feel free to contact us. We are here to help. We can talk about your specific neighborhood and what is happening there.

#siliconvalleyrealestate #realestatenews #realestatesales #siliconvalleyrealestatemarket #siliconvalleymarkettrend #santaclaracountymarkettrend #siliconvalleymarketreport #santaclaracountymarketconditions #kwsv #kellerwilliams #stevemungroup #whoyouhireabsolutelymatters #work #realtor #realestate